ML model predicts the U.S. economy

Like ocean waves, economies have cycles. Economic downturns follow cresting waves of GDP growth. Two successive quarters of negative GDP growth implies an economic recession. Economists consider an inverted U.S. Treasury Yield Curve to be a leading indicator of a future recession in the country. While we see signs of this economic phenomenon now, is it indicative of an impending recession? Our Machine Learning (ML) model forecasts the next yield curve inversion, based on the two most reliably trending U.S. Treasury yields: the 1-year yield and the 2-year yield.

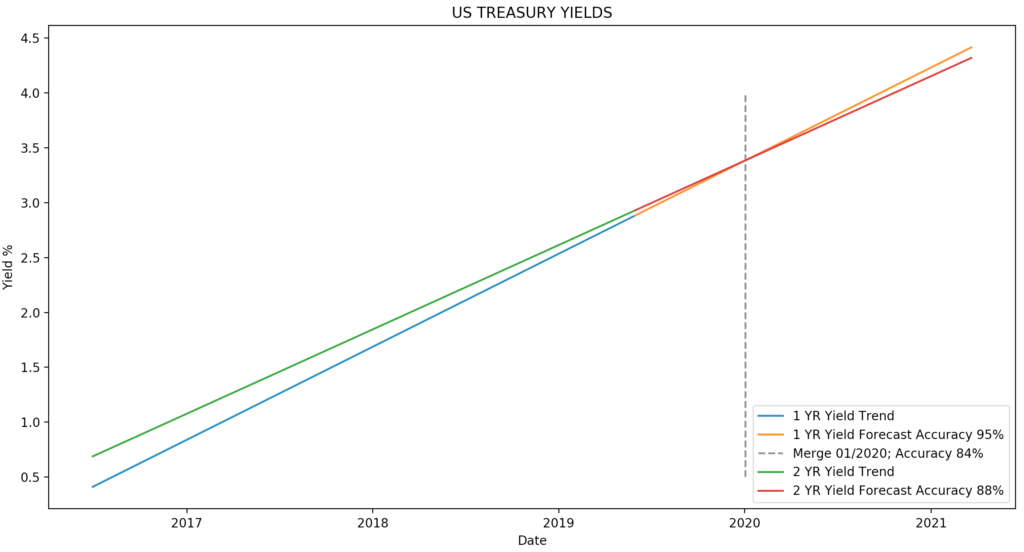

According to the figure above, the historic 1-year yield trend shown in blue is a tad steeper than the historic 2-year yield trend shown in green. This will result in the two yield trends intersecting in the future. Our model forecasts the 1-year yield trend depicted in orange with an accuracy of 95% and the 2-year yield trend depicted in red with an accuracy of 88%. Our forecast indicates the merging of these two yield trends in January 2020 with an accuracy of 84%. An inverted yield curve is a reliable precursor to a recession and the trend is your friend. Thus, our degree of confidence that there will be no recession this year is very high.

Please contact shianfernando@datasastra.com with questions or comments.